I keep saying it — and I can’t believe it — how do we continue to lose the information war when the facts are on our side? Taxpayers United of America’s Jim Tobin nails it here:

The founder of the 40-year-old non-profit Taxpayers United of America on Tuesday railed against public-employee pensions, terming them an unfair burden for private citizens who earn much less in retirement.

Jim Tobin, in his first Henry County appearance, said, “It’s ridiculous to pay people millions of dollars to do absolutely nothing for decades,” he said.

He said Henry County’s median household income is $52,000 and taxpayers are on the hook for every shortfall in the pension system, while more than 240 public retirees here accrue an estimated seven-figure total in retirement over their lifetime. He questioned how Henry County’s 50,000 residents can pay the public pensions, noting the highest private-industry Social Security annual pay is $30,000.

“We have to work full-time into our 70s so these people can kick back and absolutely do nothing for the money they are receiving,” he said. “If we don’t pay our taxes, a man with a gun will come visit us. It’s basically legal plunder for the benefit of the government class.”

He criticized the Teachers Retirement System (TRS) in particular, singling out two retired Geneseo school administrators. He said former principal Jack Schlindwein has the highest estimated lifetime payment of any public employee in Henry County at over $5.3 million after retiring at 54. He said former superintendent Harold Ford may expect an estimated $4.4 million in lifetime pension. He even noted that the two administrators’ total personal contribution to their pension of $168,380 and $138,000 respectively is likely misleading because often school districts make up the employees’ contribution.

Statewide, Mr. Tobin said 15,661 public retirees receive more than $100,000 a year and 92,386 are taking in more than $50,000 per year.

Mr. Ford said he’d guarantee he is not the highest paid former school official in the Quad-Cities area.

“I do get a very good — a very, very good amount of money for my retirement,” he said. “Even though it’s a wonderful amount, I’m sure I don’t make more than a number of people in the Quad-Cities did.”

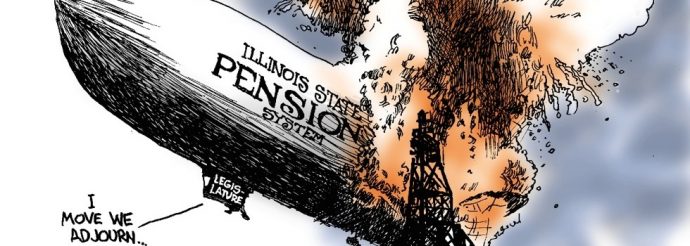

The Teachers Retirement System alone pays annual benefits of nearly $6 billion and sought $4 billion for fiscal year 2017 to make up for underfunding. With total assets of $45 billion and actuarial liability of $108 billion, it’s only 42 percent funded, but executive director Richard Ingram told the Senate this spring that investment earnings cover the majority of the costs of benefits.

Read more: The Argus Dispatch

Image credit: www.illinoispolicy.org.