Property taxes are a license to steal, plain and simple. Governmental units such as school districts love your house and the existence of what is basically a mortgage that never goes away — your yearly contribution to their bloated budgets.

Illinois’ entire tax system has to be changed. That, and bankruptcy (which I’ll address in a forthcoming article), are the two things that have to happen if Illinois is ever going to stop out-migration and recover fiscally.

Here is Andrea Riquier writing at Market Watch:

‘Enough is enough’ say buyers heading to Wisconsin, Texas, Georgia and elsewhere.

Rich Harty, co-owner of Chicago-based Harty Realty Group, has an unusual business model. As an exclusive buyer’s agent, Harty has spent the past few years leading house hunters farther afield than many expected when they started to search in his metro area.

As Harty, a lifelong Chicagoan, puts it, “I’m trying to convince them, let me show you what Wisconsin has to offer.”

Harty’s clients range from first-time buyers with sticker shock to people who’ve lived in and around Chicago all their lives. Each has a different story, but they share a common theme: many believe that Chicago-area property taxes are too high, and relief is just an hour away over the state line.

As a new report out Thursday demonstrates, Harty isn’t the only one realizing how big of an impact property taxes make on home-buying decisions.

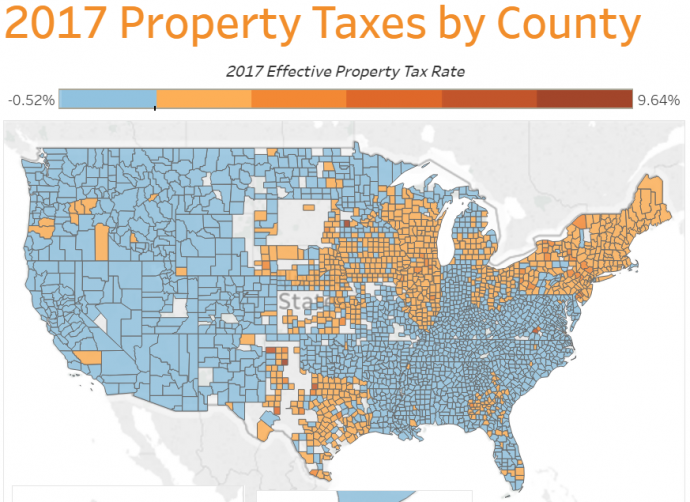

The 2017 property tax analysis from real estate data provider Attom Data Solutions shows that last year, Americans paid $293.4 billion in property taxes, a 6% increase over 2016, and an average of $3,399 per home.

But if all real estate is local, all real estate taxes may be even more so.

Attom’s data show that the average tax burden ranges from $10,612 in the most expensive metro area, Bridgeport-Stamford-Norwalk, Connecticut, to $525 in Montgomery, Alabama. And those are just averages.

Read more: MarketWatch.com

Image credit: www.marketwatch.com.