A collapsing Ponzi scheme — this is amazing research from one of the most important websites in Illinois, Wirepoints — here are Ted Dabrowski and John Klingner:

You can’t help but call it a Ponzi scheme. Not if you look at Chicago’s collapsing demographics and consider how they’re threatening the solvency of the city’s government-run pensions. Chicago households are on the hook for more than $145 billion in state and local retirement debts and there are fewer and fewer people left to pay them.

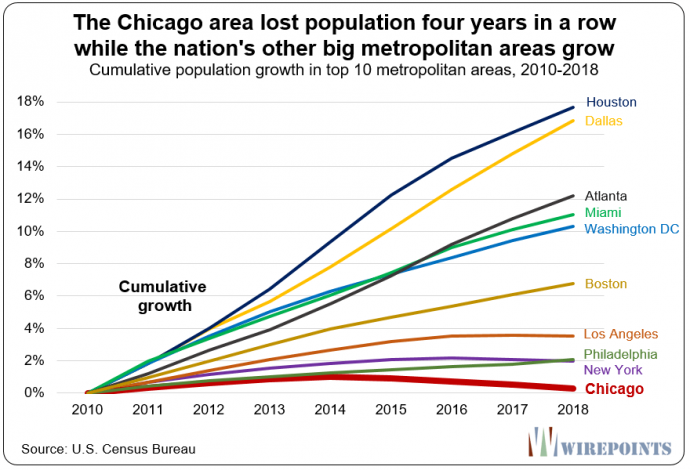

Consider first Chicago’s falling population. The city’s metropolitan population has fallen four years in a row. It’s the only top-ten city to shrink like that. In all, the Chicago MSA lost 66,000 people between 2014 and 2018.

A falling population means the city’s massive pension debts are falling on a smaller base of taxpayers. That’s bad news enough.

But another key demographic – the ratio of active government workers to pensioners – is even more concerning.

That ratio, which equaled 1.4 actives for every pensioner in 2005, has collapsed to nearly 1.05. And if the trend continues, in just a year or two there will be more pensioners draining money from the pension funds than active workers putting money in.

The problem is compounded by the fact Chicago households can’t afford the amount of pension debt that’s been racked up by state and local politicians.

Spread out the $145 billion in overlapping government pension and retiree health care debt – from the city, the Chicago Public Schools, Cook County governments and the state – and each Chicago household is, on average, on the hook for more than $139,000 each. It’s an insane amount and it’s tabulated in the following graphic. (Retirement debt calculations are shown based on both official and Moody’s-based estimates.)

What’s fascinating is that Illinois politicians think Chicagoans will willingly pay off that debt no matter what.

Read more: Wirepoints