Wirepoints’ Mark Glennon discusses two “must see” two charts (how is it that Illinois Republicans can’t make use of this information?):

Whether you know nothing or everything about Illinois’ state and local fiscal crises, take a moment to digest these two charts published by the Wall Street Journal today. Every high school in the state should be devoting a class to them, and every paper should have them on the front page. After you look at them, take a moment to consider how our political establishment is responding.

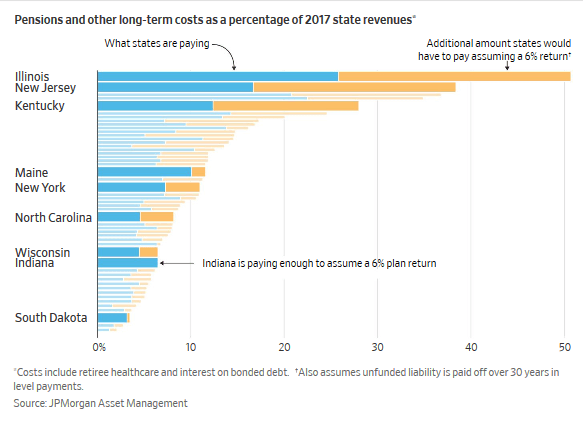

Focus on the top line in both charts. They aren’t complicated. They show how much of total revenue collected by the State of Illinois and the City of Chicago is now being consumed by payments on pensions and other debt, and how much worse it would be if proper amounts were being paid.

You read the charts right. For the state, about 25% of revenue now goes towards pensions and other debt, but that would jump to over 50% if proper amounts were being paid. For Chicago, about 34% of revenue is already being consumed by those payments but doing it right would take over 60%.

The charts are based on the work of Michael Cembalest, Chairman of Market and Investment Strategy for the asset-management arm of JPMorgan Chase & Co. Wirepoints, alone in Illinois, has been reporting that work consistently for over five years, trying to call attention to it and similar work by ourselves and others.

The implications are catastrophic. No government can provide a reasonable level of services when it is burdened so heavily by legacy pension and other debt. That’s especially true for governments with tax burdens already as high as Illinois and Chicago’s. Similar numbers apply to many other towns and cities across the state.

Read more: Wirepoints

Image credit: www.wirepoints.com.