This is an important article by Edward Ring about the corruption of government pensions. He’s one of the few people dealing with the topic with mathematical reality in mind. Here are a couple of excerpts:

Patriotic members of the public sector must make some tough choices in the coming years. If lean years come, do they want America to be run by an international plutocracy, where citizenship is meaningless, but their own jobs as government enforcers are secure and lucrative?

. . .

Wall Street’s Biggest Player: Public Employee Pension Funds

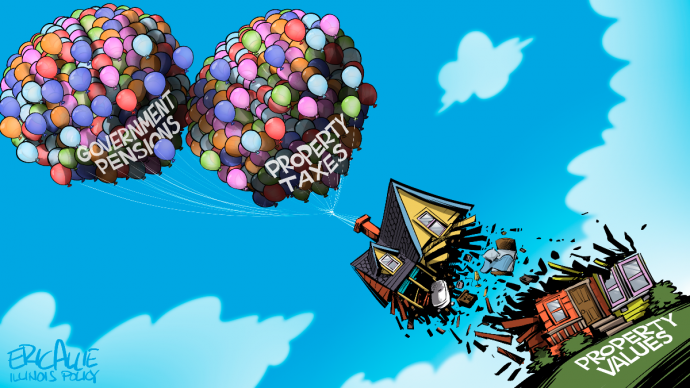

Which brings us to public sector pensions, which are among the most socially divisive, economically damaging scams that nobody has ever heard of.

To get an idea of the financial scale of public pensions, note that the U.S. Census Bureau estimates the total invested assets of pension funds managed on behalf of local, state and federal government employees is $4.3 trillion. Roughly 17 percent of Americans either work for or are retired from a local, state, or federal government agency.

By contrast, the Social Security Trust Fund, serving all 327 million Americans, and in which many government employees also participate along with receiving their pensions, has a total asset value of $2.9 trillion.

This is an incredible fact. Taxpayers—who it should go without saying, are paying for both systems—have contributed to a public employee pension system that is 50 percent larger than the Social Security Trust Fund, even though Social Security serves six times as many Americans.

. . .

How is this fair? How is it that public sector employees can collect guaranteed pensions that pay, on average, two to three times as much as Social Security and, on average, are collected ten years earlier in life?

Here is one of the key paragraphs:

The best thing that could happen to unite Americans would be to eliminate all public sector pensions and transfer the assets into the Social Security Trust Fund. One may endlessly argue the virtues or vices of Social Security, but you could do a lot worse than Social Security.

One more excerpt:

Most important, however, if there is going to be a taxpayer-funded retirement security net for all Americans, it should be one system, with one set of formulas and incentives, equally applied for all citizens…

Read the entire article: American Greatness