Here are Orphe Divounguy, Bryce Hill, and Joe Tabor writing about a needed spending cap that few Illinoisans are aware of due to the conservative movement’s failure in the information war:

Illinois is in dire fiscal straits for a very simple reason: The state perpetually spends more than it takes in.

The state has not passed a single balanced budget since 2001, despite a constitutional requirement to do so.

One long-term solution to Illinois’ budget woes? Smart growth: Tying growth in government spending to growth in Illinois’ economy. Illinoisans could then rest assured they’re getting a state government they can afford.

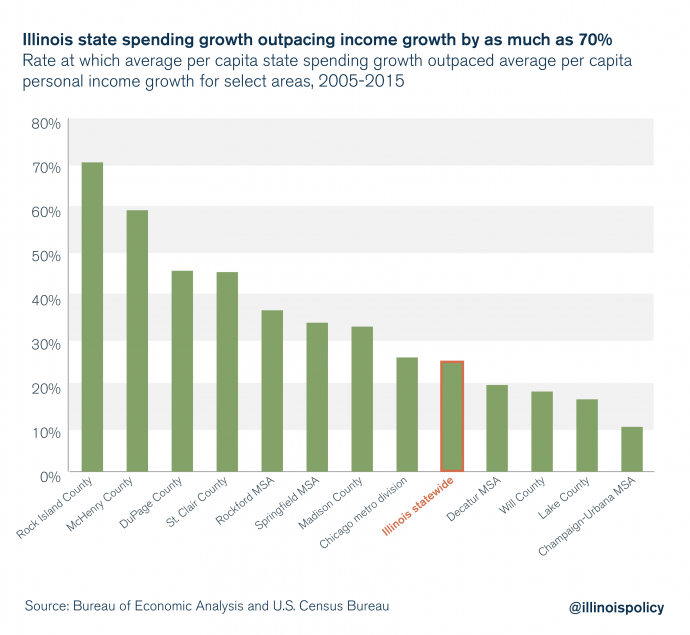

State Spending Growing Much Faster than Personal Income

Illinois lawmakers have been on a spending spree. State spending per capita grew 25 percent faster than Illinoisans’ personal income per capita in Illinois from 2005 to 2015, and there’s no sign it’ll be slowing down anytime soon.

Unrestrained growth in state government spending injects uncertainty into the lives of Illinoisans. That’s because lawmakers can do only one of two things when government spending outpaces growth in the state’s economy: raise taxes or mortgage the incomes of future generations by borrowing money.

The threat of future tax hikes makes it more difficult for families to plan for their futures in the Land of Lincoln. Increasingly, they’re planning for those futures to be in other states.

The rate at which state spending growth has outpaced personal income growth in some areas of Illinois is astounding. In Rock Island County, for example, per capita state spending growth outpaced per capita personal income growth by 70 percent per year from 2005-2015.

Illinois needs to hold state lawmakers accountable – there must be some mechanism to force politicians to spend more responsibly.

Years of Reckless Spending

One trick politicians in Springfield use to “balance” the budget is simply not appropriating funds to pay their bills. The state’s backlog of unpaid bills alone reached $16 billion toward the end of 2017 – before the state borrowed more money to pay them down to $8 billion.

Read more: Illinois Policy

Image credit: www.illinoispolicy.org.