Madoff is a good parallel — here is Dan McCaleb writing at the Illinois News Network:

“In a world full of lies, the most dangerous ones are those we tell ourselves.”

― Diana B. Henriques

HBO debuted its original movie on Ponzi-schemer Bernie Madoff over the weekend. Based on Henriques’ book “The Wizard of Lies,” the film (and book) tells the chilling tale of Madoff’s fraudulent investment scheme in which more than 2,200 people lost almost $20 billion in retirement savings.

That is a lot of victims losing a lot of money.

But it’s peanuts compared to what public pensioners – in Illinois and elsewhere – stand to lose if drastic reform measures aren’t taken soon. More on this in a moment.

A Ponzi scheme is a form of fraud in which early investors see quality returns, not because their money was invested wisely as the investors are led to believe, but because new investors fund the payouts. The cycle perpetuates itself – more and more new investors are needed to continue to fund previous investors’ returns at an unbeknownst higher risk to themselves – until it inevitably collapses.

In Madoff’s case, the collapse occurred in 2008, after almost 30 years, when the housing bubble burst and the economy was sent into the Great Recession. Simplistically, far fewer new investors could be found, and prior investors, many hurting because of the turn in the economy, asked for their full investments back.

Madoff was sentenced to 150 years in prison after pleading guilty to multiple counts of fraud. His victims suffered untold losses.

What’s the point of my Madoff history lesson?

A strong case can be made that public pensions – including in Illinois – are eerily similar to a Ponzi scheme, and that a similar collapse might be inevitable. That would mean an untold number of new victims that would make the Madoff case seem relatively minor by comparison.

The difference between a Madoff-like Ponzi scheme and the public pension crisis is that government is complicit in the latter, and that dedicated public servants, state retirees and taxpayers are the ones at risk.

Read more: ILNews.org

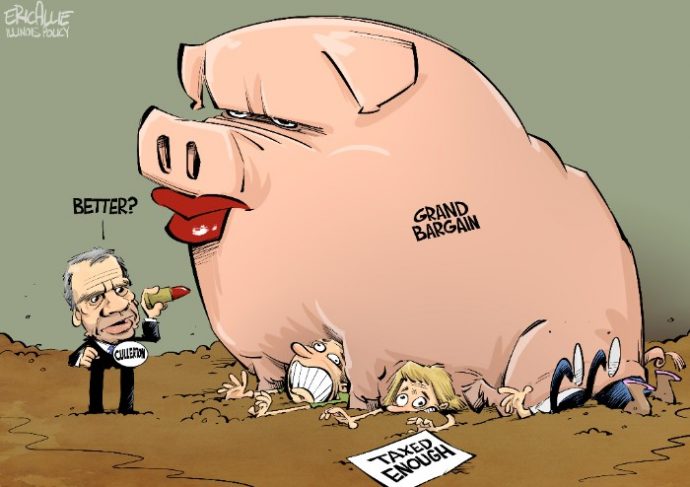

Image credit: www.illinoispolicy.org.