Ted Dabrowski and John Klingner continue their series on Illinois’ shrinking tax base:

Continued from Part 3: $310 billion in accumulated losses from out-migration.

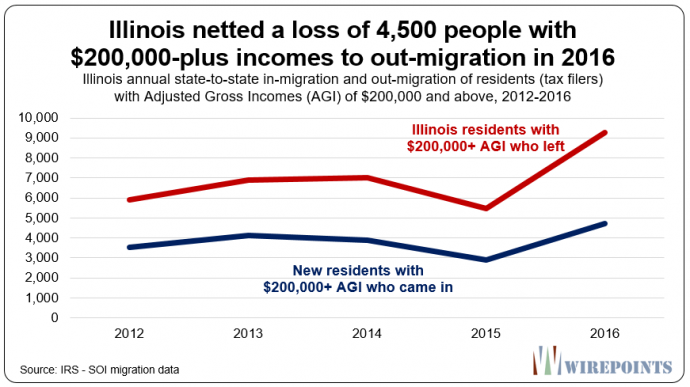

Out-migration data from the Internal Revenue Service shows Illinois’ wealthy are leaving the state at a damaging pace.

In 2016 alone, Illinois lost more than 9,200 tax filers earning $200,000 or more, while only 4,700 such filers moved into Illinois. The net result was a loss of more than 4,500 wealthy Illinois tax filers.

On a net basis, Illinois lost more wealthy residents per capita than any other state in the nation except New York.

Though Illinois’ wealthy make up a relatively small share of the people lost to out-migration, they’re responsible for the largest share of income lost to other states. When people leave the state, they take their incomes with them.

In all, Illinois suffered $11.4 billion in outflows and gained just $6.6 billion in inflows in 2016, leaving the state with a net $4.87 billion loss in Adjusted Gross Income. More than 50 percent of that came from losing people who made $200,000 or more.

Again, New York was the only state to lose more income to other states than Illinois did.

Read more: Wirepoints