How many Illinoisans know about this interest payment amount per year? Way too few. Here is Michael Lucci writing at the Illinois Policy Institute:

A golden rule of finance is this: Debt that can’t be paid won’t be paid.

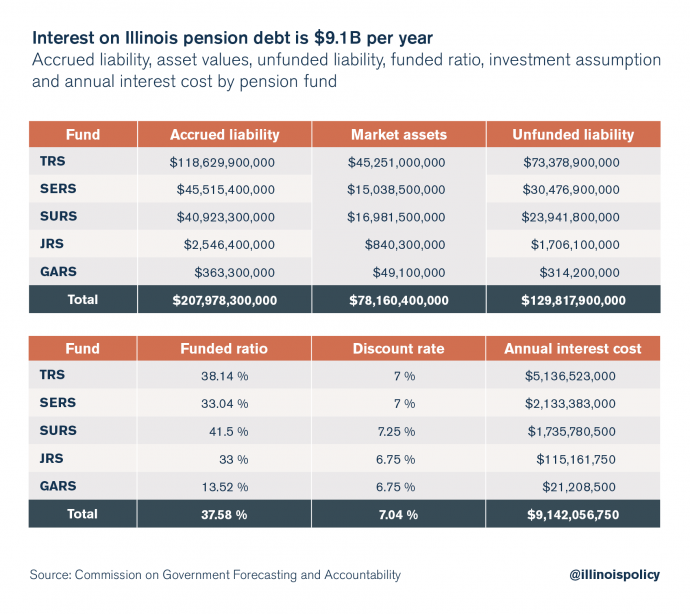

Illinois isn’t covering the interest payments on its pension debt. Those interest payments total $9.1 billion a year.

This is the reason Illinois’ pension debt continues to grow. As with personal credit card debt, until the interest is paid off none of the actual debt gets erased. Illinois’ pension debt is so large that it’s unlikely payments will cover the interest on the pension debt until 2028, according to a November 2016 special pension briefing from the Commission on Government Forecasting and Accountability.

Illinois politicians have known for years about the state’s pension crisis, even if they have not taken serious steps to address the problem. Gov. Bruce Rauner recently spoke out on the cost of interest on the pension debt. Former Gov. George Ryan weighed in as well, saying:

“First off, the biggest problem we got with the budget right now is the interest they are paying on the debt. If I were the governor, … I’d say we are never going to be able to pay the full debt back, so let’s eliminate half the debt right now and write it off.

“If that’s not constitutional, it might be worth changing the constitution. That would dramatically reduce the amount of interest that they’re paying. The bond ratings would go up and the interest would go down.”

Ryan seemed to be referring to the annual “interest cost” on Illinois’ pension debt, which is about $9.1 billion per year, or $25 million per day. The portion of interest cost that isn’t covered each year is simply added to the debt.

Why Illinois’ pension debt keeps growing

Illinois has about $78 billion in assets on hand to pay for pensions. But the present value of the state’s accrued liability is $208 billion. That leaves a difference of $130 billion, which is money the state owes – but doesn’t have.

Read more: Illinois Policy Institute