Ted Dabrowski and John Klingner at Wirepoints explain Governor Pritzker’s mission impossible:

Look for lawmakers to paint Moody’s recent report on Illinois’ proposed progressive tax scheme as a positive endorsement. The ratings agency said the new scheme would give the state more flexibility in tackling its pension crisis and budget deficits.

But if you parse the report’s words closely, the agency gives little room for Illinois to operate. In fact, Moody’s requirements for a credit positive outcome for the tax are nearly impossible for Illinois to achieve. If anything, Moody’s report should send up alarm bells. If lawmakers fail to meet the agency’s requirements, the tax could even lead to more downgrades.

In its report, Moody’s listed three requirements Illinois’ progressive tax would have to fulfill for the agency to consider it a positive for Illinois:

“A positive outcome for the state’s credit standing would require that the new system (1) yield substantial net new revenue, (2) without material damage to the economy, and that the new revenue be (3) largely allocated to addressing the state’s retirement benefit liabilities on a recurring basis.”

The problem is the state can’t accomplish all three of those things at the same time – not without major, structural reforms. Illinois is in simply too big of a fiscal hole.

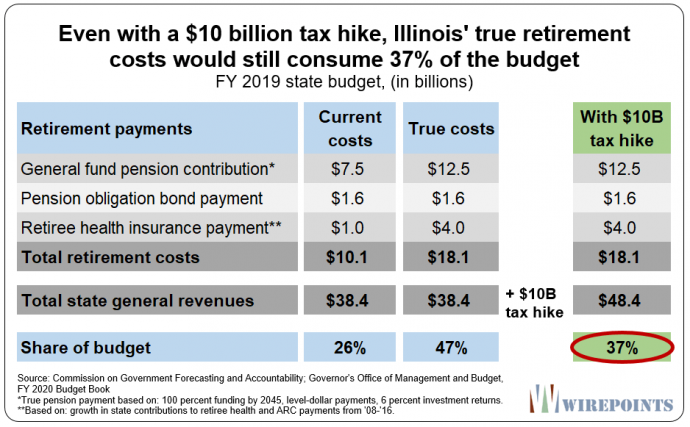

The state has operating deficits of $1-$3 billion, over $6 billion in unpaid bills, and is underfunding its retirement costs by at least $8 billion annually. To raise that amount of money, any progressive income tax that politicians create would have to hit the middle class along with the state’s wealthy taxpayers.

And those billions will all go to pay down old debts, not fund new services. That’s not a good way to encourage people to stay in Illinois.

Let’s take each of Moody’s requirements in turn:

1. “Yield substantial net new revenue”

Gov. J.B. Pritzker’s “fair tax” offer is supposed to raise $3.4 billion. That’s not “substantial” net new revenue anyway you look at it – neither for what’s needed to fund Illinois’ structural mess, nor for what’s needed based on Moody’s own analysis.

To begin with, absent reforms, Wirepoints calculates the state needs at least $5 billion more in pension funding annually to actually pay for the true cost* of its pension promises. Actuaries also say Illinois needs $3 billion more in contributions to properly pay down its $73 billion in retiree health insurance debts.

Read more: Wirepoints