Ted Dabrowski and John Klingner address Illinois property tax pains focusing in on Maine Township:

Like most people, Steve Schildwachter was initially too busy to figure out why his property tax bills kept going up. For years, the Park Ridge resident and marketing executive winced, paid his taxes and moved on. But as his property taxes nearly doubled, Steve vowed to understand his tax bill.

“People think that appealing their property assessments solves the problem. But all that does is push the burden away from you and onto your neighbors. It doesn’t do anything to lower overall taxes or slow down spending, driven largely by school districts. The real problem is spending. Governments decide how much they want to spend and then they just give you your share of the bill.”

Steve is right. In Park Ridge, property values still haven’t recovered from the effects of the Great Recession, yet local officials continue to tax more and more, especially to pay for schools and local pensions.

School district costs

In Park Ridge School District 64, for example, property values are down 21 percent compared to 2009, yet the district has hiked taxes by more than $10 million, or 17 percent, over the same period. That hurts since taxes for schools typically make up 60 to 70 percent of a resident’s property tax bill in Illinois.

Part of those higher property taxes go to pay for increasingly expensive compensation. Forty percent of the district’s full-time employees made more than $100,000 last year. The highest paid of all were the district’s administrators. The top five all received between $140,000 and $300,000 in total compensation.

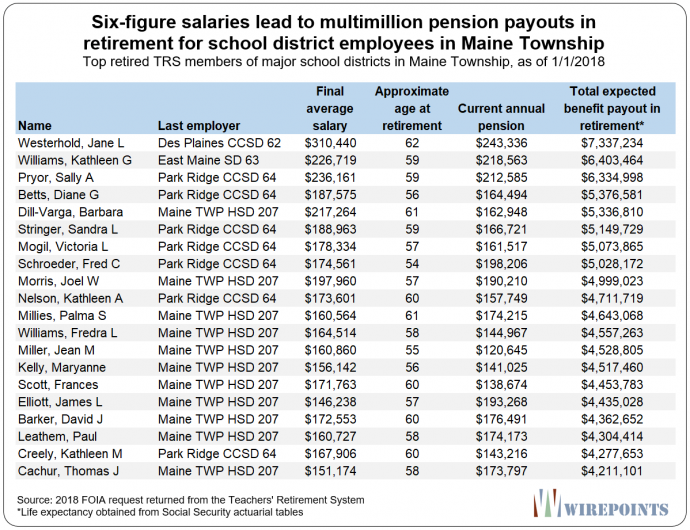

Those six-figure compensation packages will translate into multi-million dollar pensions when those bureaucrats retire, not just at Park Ridge, but also at Maine Township’s other districts.

The top 20 retirees from Maine Township’s four main school districts are [listed in the graph above this article]. If they live to their full life expectancy, they’ll each receive between $4 to $7 million dollars during their retirements, depending on their starting pensions.

Read more: Wirepoints