This study should be a surprise to no one. Here is Michael Carroll writing at the Illinois News Network:

Newly released data on state and local pension systems across the nation show that their liabilities may be more ominous than previously imagined, placing underfunded pension systems in states such as Illinois in peril.

California’s Hoover Institution released a study last month showing states have been hiding their true pension debts by relying on overly optimistic market returns of more than 7 percent. The analysis performed by Hoover Senior Fellow Joshua Rauh examines pension liabilities based on more realistic expectations that pension asset growth will mirror the yields of government bonds.

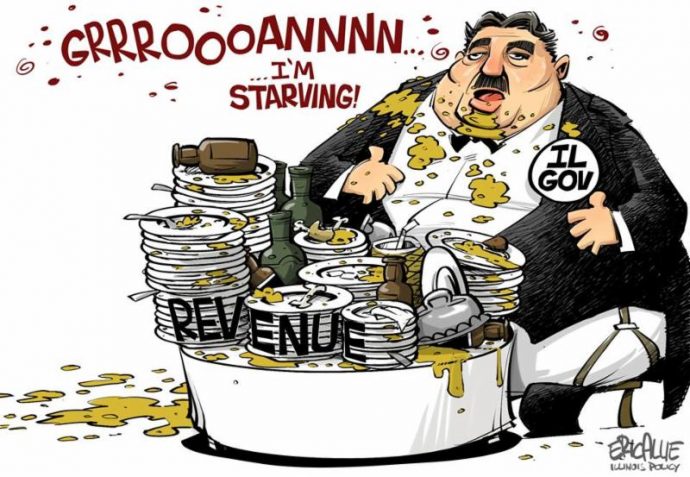

“While state and local governments across the U.S. largely claimed they ran balanced budgets, in fact they ran deficits through their pension systems of $167 billion,” Rauh said.

In his analysis, Illinois has on hand only 29 percent of the funds needed to meet the promises made to current and future retirees. That’s the worst record of any state, and Rauh concludes that for the state to stop sinking further into debt, it would have to contribute more than twice what it contributes now.

Illinois now devotes nearly 25 percent of its state budget to the state worker pensions, so doubling that figure means close to half of the state’s revenues would have to go to pensions to avoid accumulating further debt.

“I think people increasingly understand that they’re throwing tax dollars into a bottomless pit,” Mark Glennon, the founder of the WirePoints website and a former venture capitalist and financial adviser, told Illinois News Network.

Putting more money in the current system is futile, according to Glennon.

“The smart ones already know the current situation, but they’re not honest enough to talk about it in public,” he said.

Read more: Illinois News Network

Image credit: www.illinoispolicy.org.