Yes, but how many Illinoisans will actually find out that the Case For Illinois’ graduated income tax is dishonest? Very few. Here is Mark Glennon:

The case for the Fair Tax – a graduated income tax in Illinois – is being made so dishonestly that a detailed look is in order.

Supporters say it will plug Illinois’ fiscal hole, reduce property taxes, address our pension crisis, provide more funding for schools and more.

In fact, if Governor JB Pritzker’s Fair Tax proposal becomes law, Illinoisans will quickly discover they were duped into throwing more money at a doomed effort. The new revenue would barely dent our problems and only further enrage the Illinoisans who are already fed up and ready to leave.

Let’s start with the messages you’ve already been hearing, then look a particularly deceitful article published today in Crain’s by two prominent supporters of the tax hike.

The biggest whopper is being told by Think Big Illinois, the primary group supporting a progressive income tax for Illinois, whose backers include Pritzker. It’s the subject of my monthly article in Crain’s Chicago Business this week. Here’s what they’re claiming:

“Illinois is in a $3.2 billion financial hole. A Fair Tax could fix that and reverse the damage.”

If only the hole indeed were just $3.2 billion. Most Illinoisans of any political stripe would probably be happy to pay up and call it a day to fix our fiscal crisis, no matter how the burden was distributed.

But it’s preposterous – off by several multiples, depending on exactly what you choose to count.

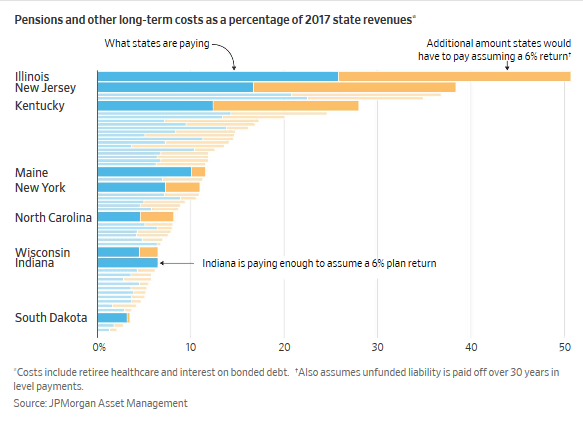

Just the annual funding shortfall for the state’s five pensions alone is $4.7 billion per year. That’s based on the “actuarially determined contributions” contained in the most recent actuarial reports, and they’re based on assumptions widely regarded as far too optimistic.

But the new tax would raise only $3.4 billion per year. (That’s the administration’s claim, though the estimate has been heavily criticized as too optimistic). In other words, the new tax wouldn’t come close to solving the state’s pension crisis, never mind the hundreds of local pension funds across the state.

Read more: Wirepoints

Image credit: www.wirepoints.com.