Ted Dabrowski and John Klingner explain how Illinois cities are getting crushed by pension costs:

Illinois politicians’ refusal to address skyrocketing municipal pension costs is destroying cities across the state. Some cities like Harvey and East St. Louis are beyond repair, with the Illinois Comptroller already stepping in to confiscate city revenues on behalf of the municipalities’ grossly underfunded pension plans. Most other cities are deteriorating quickly. They’re fighting ever-increasing pension costs that are swallowing city budgets and chasing residents away. More than half of Illinois’ 650 public safety plans are less than 60 percent funded.

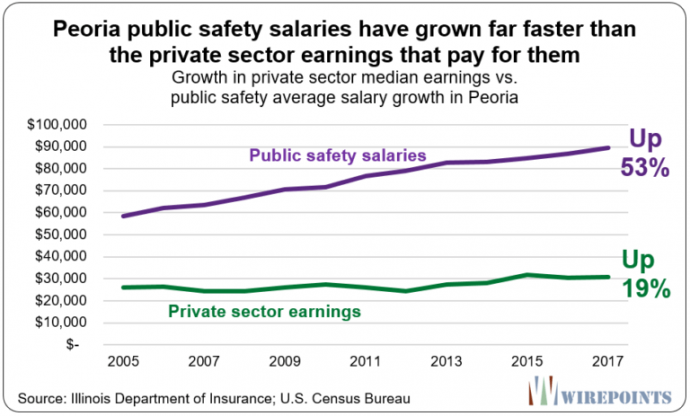

Peoria is one of those struggling cities. No, it’s not a Harvey or an East St. Louis, but it’s certainly in a downward spiral like many other cities. Peoria officials are adding new taxes and fees to deal with the city’s struggling budget. A new utility tax was added in 2018, along with a public safety pension fee that’s being ratcheted up over the next couple of years. Their efforts to tax more are likely to be futile. The numbers justify those doubts.

To understand why, take a look at how much Peoria residents have put into public safety pensions since 2005, only to see things dramatically worsen over the decade. It’s a reality cities across the state face: retirement security for public safety workers is collapsing despite the billions of additional taxpayer dollars poured into local pension funds.

Peoria’s woes

Peoria taxpayers have more than doubled their yearly contributions to the city’s police and fire pension funds, to $17 million in 2017 from $7 million in 2005. Despite all that extra funding, the combined shortfall in Peoria’s police and fire pensions have jumped 2.7 times.

Public safety pensions were “just” $100 million underfunded in 2005. But after more than $155 million in cumulative taxpayer contributions to the funds from 2005 through 2017, the shortfall in the funds nearly tripled to $275 million.

How can that happen? How can so much money go in and yet the plans get so dramatically worse? How can retirement security collapse so quickly for hundreds of city workers?

Read more: Wirepoints