How many over-burdened Illinois taxpayers hear about this report from Moody’s? Very few. Here is Adam Schuster writing at the Illinois Policy Institute:

llinois’ pension debt has set a new record to which no state should aspire.

Credit ratings agency Moody’s Investors Service released a report Aug. 27 comparing unfunded pension liabilities across all U.S. states. According to the report, Illinois’ unfunded pension liabilities grew 25 percent in fiscal year 2017 to $250 billion. That equates to 601 percent of “own source” revenue, meaning money brought in by the state excluding federal funds. That ratio of pension debt to revenue is the highest on record for any U.S. state, according to Moody’s. The national median is 107 percent.

This matters much for the same reason banks look at an individual’s debt-to-income ratio when considering applications for a personal loan. Banks typically won’t issue a qualified mortgage to anyone with a debt-to-income ratio of more than 43 percent.

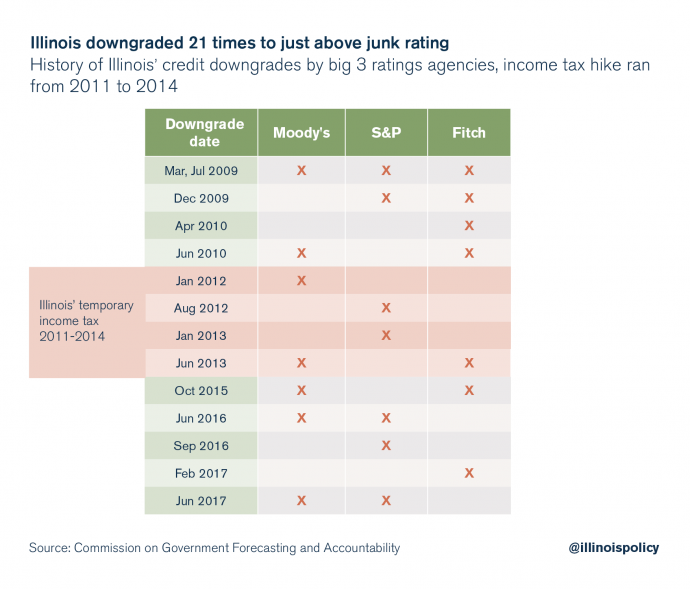

When a state’s pension debts far exceed its revenue, that means those debts are less likely to be repaid. Illinois’ inability to manage its pension system in a sustainable and affordable way is one of the main reasons both Moody’s and S&P Global Ratings put the Prairie State’s bond rating just one notch above “junk” status. The state’s credit rating has been downgraded 21 times since 2009, primarily due to runaway pension debt.

A low bond rating increases the cost of borrowing money for taxpayers and makes it difficult for state government to invest in core services residents want, such as needed infrastructure improvements.

Other measures of the state’s ability to repay pension debt tell a similarly bad story for Illinois. The state has the worst pension debt in the nation as a percentage of both GDP and personal income, which are broad economic measures that indicate how much money is being brought in by the funding sources for government expenditures: individual and corporate taxpayers.

Read more: Illinois Policy