Ted Dabrowski and John Klingner at Wirepoints explain how the Illinois pension hole deepens:

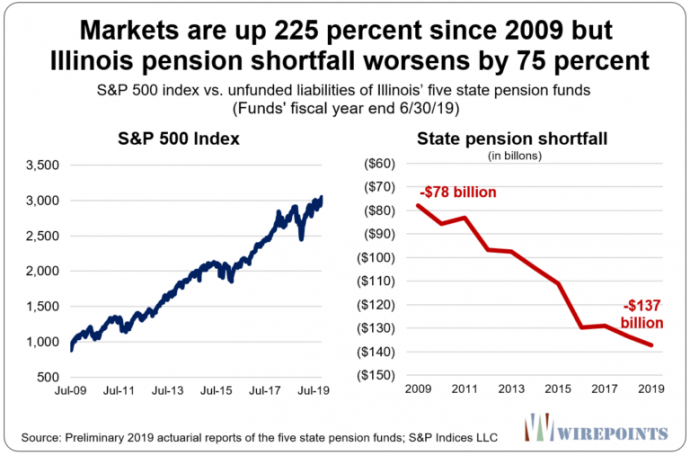

Not even the nation’s longest-ever bull market run has been able to save Illinois’ crumbling pension funds.

Despite a tripling in the value of the S&P 500 index since July 2009, Illinois’ pension shortfall has worsened by 75 percent during the same period.

In 2009, the shortfall in Illinois’ five state-run funds stood at “just” $78 billion. Today, the funding hole is at a record $137 billion, a $59 billion increase. That’s according to preliminary actuarial reports recently released by the state pension funds.

The warning this trend provides is stark: if pension debts in Illinois continue to grow during a period of remarkable stock market returns, imagine how those funds will fare when the next recession inevitably hits.

The state’s overwhelming pension costs are leaving no Illinoisans unscathed. The state’s total combined state and local taxes, adjusted for cost of living, are now the third-highest in the country, according to Wallethub. Home values, adjusted for inflation, are negative and bucking the upward trend in the rest of the nation. And core services are being cut to make room for contributions to the pension funds. Pension costs already consume more than 25 percent of the state’s general fund budget. No other state in the country spends that much on pensions.

At just 38 percent funded, only Kentucky (34 percent) and New Jersey (36 percent) have worse-funded pensions than Illinois, according to the Pew Charitable Trusts’ most recent state-by-state comparison.

Chicago’s pensions suffering even more

Chicago has suffered the same downhill trend as the state, but it’s problems are far more acute.

The city’s pension hole – what it owes to police, firefighters, laborers, municipal workers and teachers – deepened by 150 percent over the decade even as markets gained ground.

In 2009, Chicagoans were on the hook for about $17 billion in official pension shortfalls. Today, they’re on the hook for over $40 billion.

Read more and view all the charts: Wirepoints