“Overpromising” public pensions is the problem — yet few if any Republicans in Illinois seem to want to make an issue of it. In fact, we wouldn’t even know about it if it weren’t for the work of conservative and limited government policy experts.

If facts like these ever reach a large enough audience, the GOP here can win enough seats to govern the state. Of course, that would require Republican elected officials that actually know how to govern.

Here are Ted Dabrowski and John Klingner writing at the excellent and must-read website Wirepoints:

Introduction

The real problem plaguing public pension funds nationwide has gone largely ignored. Most reporting usually focuses on the underfunding of state plans and blames the crises on a lack of taxpayer dollars.

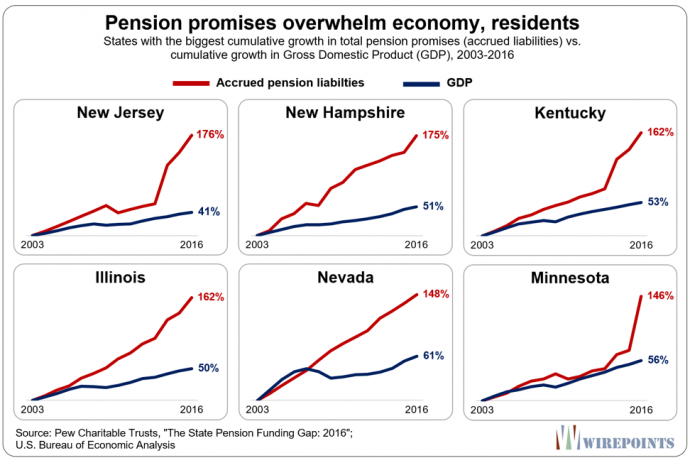

But a Wirepoints analysis of 2003-2016 Pew Charitable Trust and other pension data found that it’s the uncontrolled growth in pension promises that’s actually wreaking havoc on state budgets and taxpayers alike. Overpromising is the true cause of many state crises. Underfunding is often just a symptom of this underlying problem.

Wirepoints found that the growth in accrued liabilities has been extreme in many states, often growing two to three times faster than the pace of their economies. It’s no wonder taxpayer contributions haven’t been able to keep up.

The reasons for that growth vary state to state — from bigger benefits to reductions in discount rates — but the reasons don’t matter to ordinary residents. Regardless of how or when those increases were created, it’s taxpayers that are increasingly on the hook for them.

Unsurprisingly, the states with the most out-of-control promises are home to some of the nation’s worst pension crises. Take New Jersey, for example. The total pension benefits it owed in 2003 — what are known as accrued liabilities — were $88 billion. That was the PV, or present value, of what active state workers and retirees were promised in pension benefits by the state at the time.

Read more: Wirepoints

Image credit: www.wirepoints.com.